What Are My Rights Under the Fair Credit Reporting Act in Kentucky?

Written by Cooper & Friedman PLLC on November 7, 2022

When the word ‘credit’ is mentioned, do your ears perk up or do you find yourself running for the hills? There are so many perceptions and experiences all across the board when it comes to credit and the like that it wouldn’t be surprising if you said yes to either option, or if you remained completely unaffected by the word.

Credit is one of those things that always seems to be around, but you can never seem to grasp unless you make big steps towards understanding the ins, outs, and jargon of the subject. The only thing is, when it comes to finances, credit plays a big part that becomes much more noticeable once you need to make decisions regarding money.

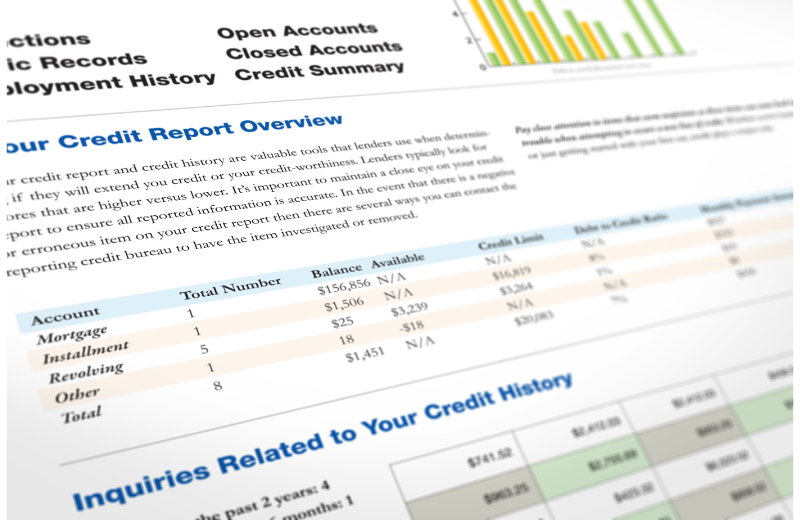

That’s why it’s important to keep an eye on your credit reports, or utilize a service that does it for you, so that you know immediately if something changes in a way that will affect you in the long run. Most of these service do have a fee to access your score and information pertaining to credit changes, but not all. There are services such as Credit Karma, Credit Sesame, or Wallet Hub that advertise free credit monitoring, but this is only for one of the three credit reporting agencies (CRAs) that make a difference in your score. For a comprehensive report, most of the time, there is a fee.

Still, one is better than none! And when it comes to credit reports, or rather, fair credit reporting, it’s important to know that you have rights whether you check your score every day or every decade.

The Fair Credit Reporting Act (FCRA)

The FCRA was an act established in 1970, when before, there was no protection when it came to consumers and the information that was listed on their credit reports – whether it was being used, sold, even what was on it. Sometimes, people just didn’t have the right to know if they weren’t actively handling the credit report, which made credit a much riskier business than it is today.

Luckily, we’ve evolved past that time, and are now protected by the rights outlined by the FCRA. The official government PDF is found on the Consumer Finance page, but we’ve done our best to paraphrase your rights in terms you can understand even if you’ve never heard of fair credit reporting rights until today.

You Have the Right To…

- You have the right to know if information in your file has been used against you.

If you’ve had an adverse action – such as a denial for credit, insurance, or employment – taken against you on a basis originating from information on your credit report, then those who denied you must tell you the name, address, and phone number of the credit reporting agency that provided the information. This is so that you are given the tools to follow up and correct your situation.

- You have the right to know what is in your file (known as a ‘Consumer Disclosure’).

Your information is readily available to you at all times, given that you have the necessary identification documents handy (which may include your Social Security Number, so don’t be alarmed). This is also free of charge (excluding your credit score) if:

-

- A person has taken adverse action against you because of information in your credit

report - You are the victim of identity theft and place a fraud alert in your file

- Your file contains inaccurate information as a result of fraud

- You are on public assistance

- You are unemployed but expect to apply for employment within 60 days

- It is your first disclosure of the year (this applies to all three CRAs, meaning you get a free disclosure from each; see www.consumerfinance.gov/learnmore for additional information)

- A person has taken adverse action against you because of information in your credit

- You have the right to ask for a credit score.

As mentioned above, you are not entitled to a free credit score, but you are entitled to the request of one. See the above resources of free credit monitoring or visit Forbes’s list of the best credit monitoring services of August 2022.

- You have the right to dispute incomplete or inaccurate information.

If you identify information in your file once you receive your Consumer Disclosure that is incomplete or inaccurate and take the steps to report it to the consumer reporting agency, the agency must investigate unless your dispute is frivolous. Visit www.consumerfinance.gov/learnmore for further explanation of dispute procedures.

- You have the right to the correction or deletion of inaccurate, incomplete, or

unverifiable information.

Going hand in hand with the previous right, inaccurate, incomplete, or unverifiable information must be

removed or corrected, usually within 30 days of your dispute that is proved as being inaccurate, incomplete, or unverifiable. However, a consumer reporting agency may continue to report information if it has been verified as accurate, regardless of your dispute.

- You have the right to dismiss outdated, negative information.

In most cases, a consumer reporting agency may not report negative information that is more than seven years old, or bankruptcies that are more than 10 years old – this does impact your credit, and doesn’t have to be there.

- You have the right to security.

You should be able to trust that your credit file isn’t available to anyone who wants to see it – consumer reporting agencies may provide information about you only to people with a valid need. This is usually in the case of considering an application with a creditor, insurer, employer, landlord, or other business. The FCRA specifies those with a valid need for access and monitors this need closely.

- You have the right to consent.

Again, this goes along with the security of your file in that consumer reporting agencies are not allowed to give out information about you to your employer or a potential employer without your written consent given to the employer. There is a stipulation, however, in that written consent generally is not required in the trucking industry.

- You have the right to limit unsolicited “prescreened” offers of credit and insurance based off your information.

Unsolicited “prescreened” offers for credit and insurance must include a toll-free phone number you can call if you choose to remove your name and address from the lists these offers are based on, so that you don’t have to pay to stop them. You may opt out with the nationwide credit bureaus at 1-888-5-OPTOUT (1-888-567-8688).

- You have the right to seek damages from violators.

If a consumer reporting agency, a user of consumer reports, or a furnisher of information to a consumer reporting agency violates the FCRA, you may be able to sue in state or federal court. If you think you have been victim to an FCRA violation, you can always contact Cooper and Friedman!

- You have additional rights if you are a victim of identity theft or are active military personnel.

For more information, visit www.consumerfinance.gov/learnmore.

That about sums up your rights under the FCRA. When it comes to fair credit reporting, that’s where it all is – there is no statute in Kentucky otherwise that deals directly with credit information, reporting, and rights, except for the KRS Chapter 367.00 §310, which states that a credit reporting agency cannot maintain information relating to a criminal charge within the state unless it resulted in a conviction, which was put into place in 1980. But, other than this one statute, all of your rights are conglomerated in the FCRA, which makes it a very important facet of your credit information and a powerful tool for you to have in your corner.

If you or someone you love has suffered from a credit reporting violation in the State of Kentucky and are in need of an experienced Unfair Credit Reporting & Debt Collection attorney, give the lawyers at the Cooper & Friedman law firm a call. The attorneys at Cooper and Friedman PLLC have over 50 years of combined experience defending the rights of unfair credit report victims. Schedule a free case consultation with an attorney by calling 502-459-7555 today.